- Banco Crèdit Andorrà (Panamá) S.A.

- Our services

- Methods

- Credentials

- Location

- Contact us

Metodology

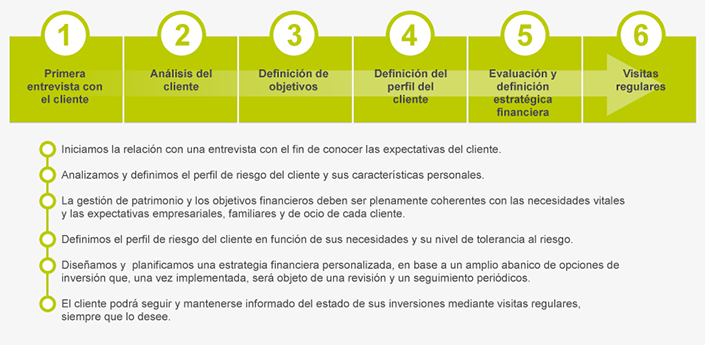

Our methodology is well thought out and based on the interaction we have with our clients. Easy access coupled with continuous evaluation and communication with clients yields the results our clients wish to achieve in meeting their investment goals. Working with our clients to implement investment plansWe begin with an interview to understand the client's expectations, risk appetite, liquidity needs and investment goals. Our goal is to come up with suitable solutions that will meet our clients’ expectations. | Continuous monitoring and effective adaptation to changeIn an ever-changing world in which client priorities, preferences and needs fluctuate, our managers also closely monitor market changes, thus ensuring that our clients’ wealth can be managed flexibly by adapting to new needs that arise and changing market trends. Our continuous work with our clients and our close relationship with them are the basic building blocks for attaining their investment goals. Wealth management is a process in constant evolution underpinned by the specific needs of each client. Throughout the process, there is a constant dialogue between managers and clients. |

- 1Initial interview with the client

- 2Client analysis

- 3Objective-setting

- 4Definition of client profile

- 5Financial strategy evaluation and definition

- 6Revisions / adjustments

The relationship begins with an interview to understand the client's expectations.

We analyse and define the client's risk profile and personal characteristics.

Wealth management and financial goals must be fully consistent with the vital needs and with each client's expectations vis-a-vis business and family financial matters.

We define the client's risk profile based on their needs and risk tolerance level.

We design and plan a personalised financial strategy based on a wide range of investment options which, once implemented, are periodically monitored and reviewed.

Meetings are held periodically to discuss the extent to which goals are being met and to make any necessary changes.