- Banco Crèdit Andorrà (Panamá) S.A.

- Our services

- Methods

- Credentials

- Location

- Contact us

Financial Investments

At Banco Crèdit Andorrà (Panamá) we manage clients' investments to obtain returns for them that are in keeping with their needs, their expectations and their investment profiles. To do so, we offer personalised solutions for clients who need financial investment advice.

Using a wide range of investment options and a philosophy of financial independence and guided open architecture, we plan and design personalised financial strategies, investing in different types of assets.

Banco Crèdit Andorrà (Panamá) implements strategies that take the constant evolution of the markets into account and we manage our clients' investments to earn yields that are in line with their requirements, their expectations and most important with their investment profiles.

Fixed income

If you wish to access the fixed income market, Banco Crèdit Andorrà (Panamá) has a special platform available to do so. We recommend that you work with our evaluation team, which can offer you access to the primary and secondary markets while upholding the rules of transparency at all times.

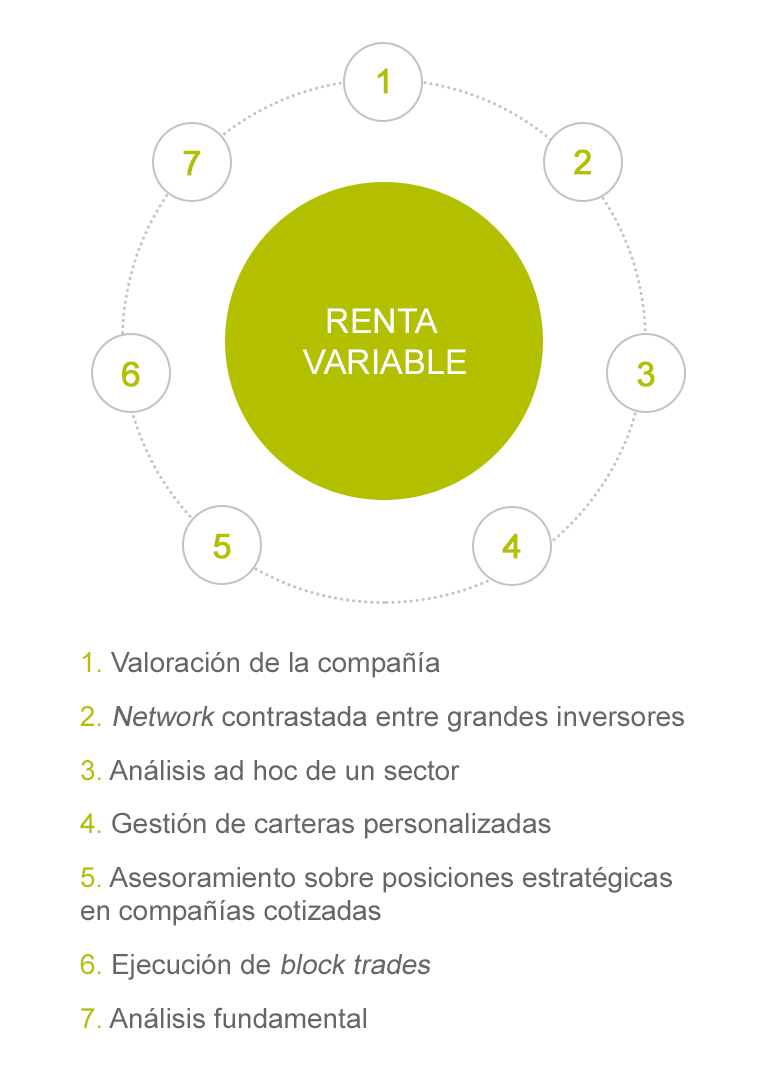

Equities

For equity investments, we offer an assortment of services ranging from business analysis and evaluation to customised portfolio management. We aim to give clients all the support they need throughout the investment process.

Equities

Fundamental analysis

Proprietary and third party investment funds

Crèdit Andorrà Group's clients have access to a wide range of funds through the Group's open architecture platform and structure. Investors can choose from different geographical areas, types of assets and fund management styles.

Alternative Investments

Structured products, hedge funds and private equity.

Alternative investments can form part of a well diversified investment plan, whose risk levels will vary depending on each individual’s investor profile. Although these investments tend to be more illiquid with a longer term time horizon for investment return, they often tend to provide access to an asset class, sector or idea otherwise not available in public listed markets.